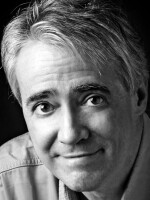

SCOTT SIMON, HOST:

Elon Musk began to lay off workers at Twitter this week, wasting no time to try and cut costs at the company that is now his. He borrowed $13 billion to buy Twitter, has to find a way to pay that back. NPR's David Gura joins us now. David, thanks so much for being with us.

DAVID GURA, BYLINE: Happy to be here, Scott.

SIMON: So what point is there to being the richest man in the world if you've got to borrow $13 billion to buy a company?

GURA: Very good question. He's put himself in a really tough position, Scott. On the one hand, Elon Musk has all these decisions to make about how Twitter works, how he's going to change the platform, who's allowed on Twitter, who can post what, who's verified - all of which are big questions. But if you set those aside, Musk also has to figure out how to make this deal work. And to say that's challenging is an understatement. He paid $44 billion for the company, but more than a quarter of that is money he borrowed. Joshua Cascade is a private equity investor who is also a lecturer at Yale School of Management.

JOSHUA CASCADE: He's in a real bind, and he will not be able to bail himself out with just cutting costs. No one ever can.

GURA: In short, Musk has to cut costs at Twitter and get it to make more money because so much revenue is going to go toward those debt payments. Twitter was already loaded up with debt before this deal. And remember, Scott, this is not a company that's been reliably profitable.

SIMON: Reportedly, nearly half of Twitter's workforce has been laid off by Elon Musk. And with due regard to the loss they suffer in livelihood, is that pocket change?

GURA: Well, it's one way to cut costs; Twitter has staffed up in recent years. And it sends a very dramatic message. Musk has only owned this company for just over a week, and Twitter told everyone to stay home on Friday and announced these layoffs over email. But even if Twitter cuts half its workforce, the numbers still are not going to add up. You know, the economy has really soured since Musk made his offer for Twitter. Tech stocks have fallen dramatically. Tech companies are freezing hiring and laying off workers. There's just so much uncertainty about the economy right now. So if you look at Twitter's competitors and what they're doing when it comes to staffing, it's likely Twitter would have made some cuts anyway if Musk had not bought this company.

SIMON: So how does he make Twitter profitable?

GURA: A big story this week had to do with verification - who gets a so-called blue check on the site, how we know that @nprscottsimon is, in fact, you, Scott.

SIMON: Yeah, we're both blue-checked, David, yes.

GURA: I hope you appreciate that shameless plug. Well, Musk has suggested charging users $8 a month for the privilege of getting verified. And that's one way Twitter can raise some money. But, again, it's only going to make a dent on these really big, massive debt payments. The way Twitter makes money - and it has made money - is from advertising. But we've heard from other social media companies that lots of businesses are pulling back on digital ad spending in the face of economic uncertainty. And beyond that, what we've seen since Musk bought Twitter is advertisers getting cold feet - wondering what's going to happen, curious if users are going to stay or go, nervous about its owner's plans. And many of them are taking a pause including GM, General Mills and Audi. Of course, that's not going to help with Twitter's cash flow...

SIMON: Yeah.

GURA: ...And neither are calls we've heard from advertisers to boycott the site completely.

SIMON: What could come next?

GURA: These are early days yet. We've seen Elon Musk float changes, then clarify them or walk them back. Joshua Cascade says what surprises him is that so many big banks went along with this deal, that they lent Musk money at the top of the market when the fundamentals didn't make sense, when the math didn't add up. Cascade really faults them for making that decision.

CASCADE: They're in bed together. I think you're going to see the banks take major losses, hold that debt for many years, even though it's worth less on paper. And I think they're all going to wait to see if he can dig his way out.

GURA: Cascade says right now there is not a market for that debt with Twitter's financial problems and that economic uncertainty again. So they're going to bide their time - doomscrolling, Scott, like the rest of us.

SIMON: NPR's David Blue-Check Gura, thanks so much.

GURA: (Laughter) Thank you, Scott. Transcript provided by NPR, Copyright NPR.