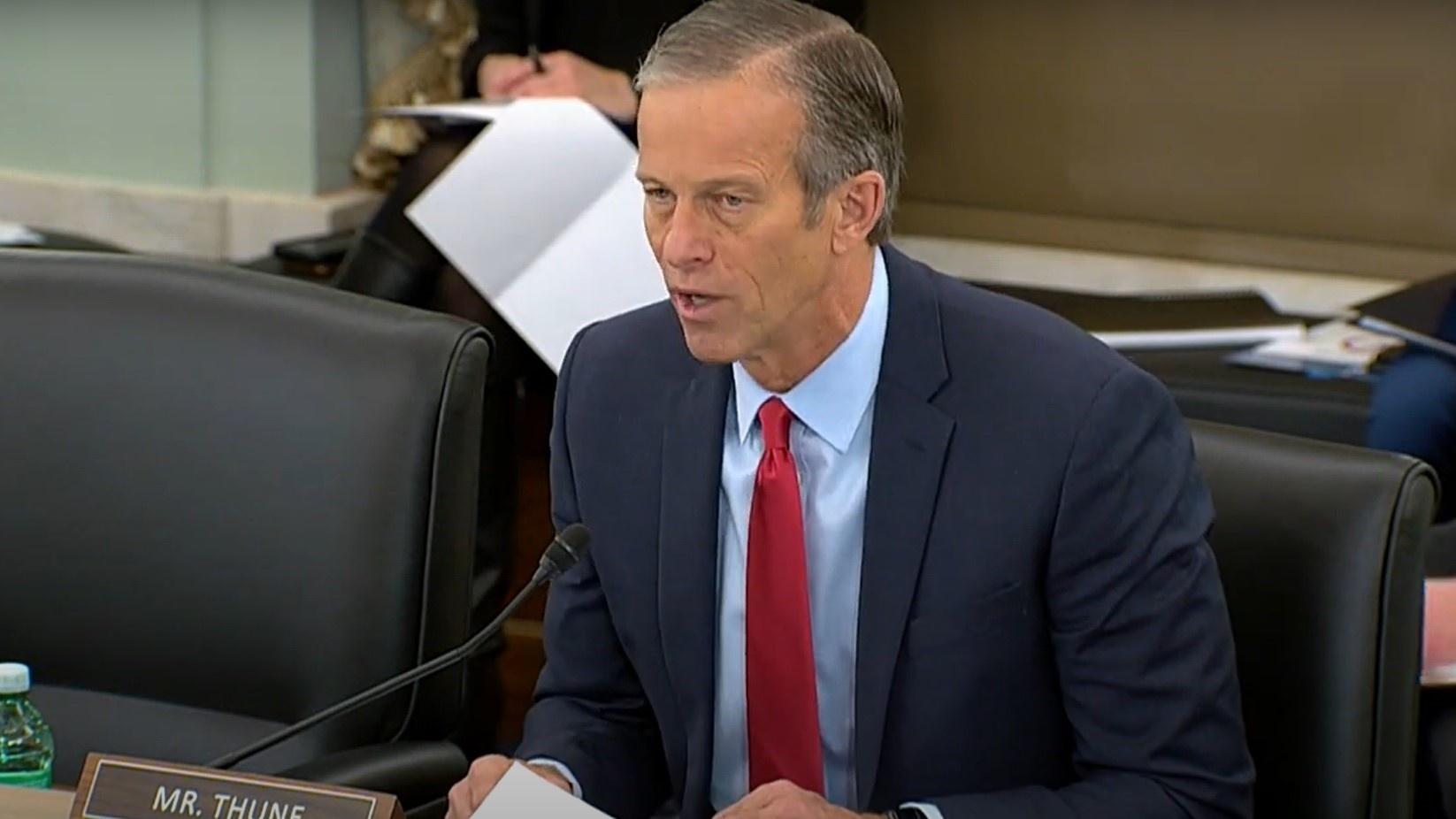

U.S. Sen. John Thune, R-S.D., told a Senate subcommittee Tuesday that venture capital is too attached to the coasts.

He said California attracted half of all U.S. venture capital last year, and that state along with New York and Massachusetts accounted for 75 percent.

“Without greater access to capital in underserved regions, the flow of talent, wealth and opportunity will continue to move to only a handful of coastal cities,” Thune said, “and the full reach and diversity of American ingenuity will go unrealized.”

A Rapid City man testified during the hearing.

Ray Hespen is the co-founder and CEO of Property Meld. The five-year-old Rapid City startup has 44 employees. It sells an automated system that helps property managers keep up with maintenance.

Hespen said entrepreneurs in the middle of the country need access to investors and advisers.

"Could we have done this with just capital and not the mentorship we received? I would say it would’ve been doubtful to have the success that we’ve had,” Hespen said. “And if it was the flipside to have the mentorship and not the capital, do I think it could’ve been done? It would’ve also been a little doubtful in my mind.”

The hearing of the Subcommittee on Communications, Technology, Innovation and the Internet was about expanding entrepreneurship beyond hubs like Silicon Valley. Thune is the subcommittee chairman.

-Contact SDPB reporter Seth Tupper by email.